Foreign Banks Important in Improving Banking Services, Finance Sector: Entrepreneur - ENA English

Foreign Banks Important in Improving Banking Services, Finance Sector: Entrepreneur

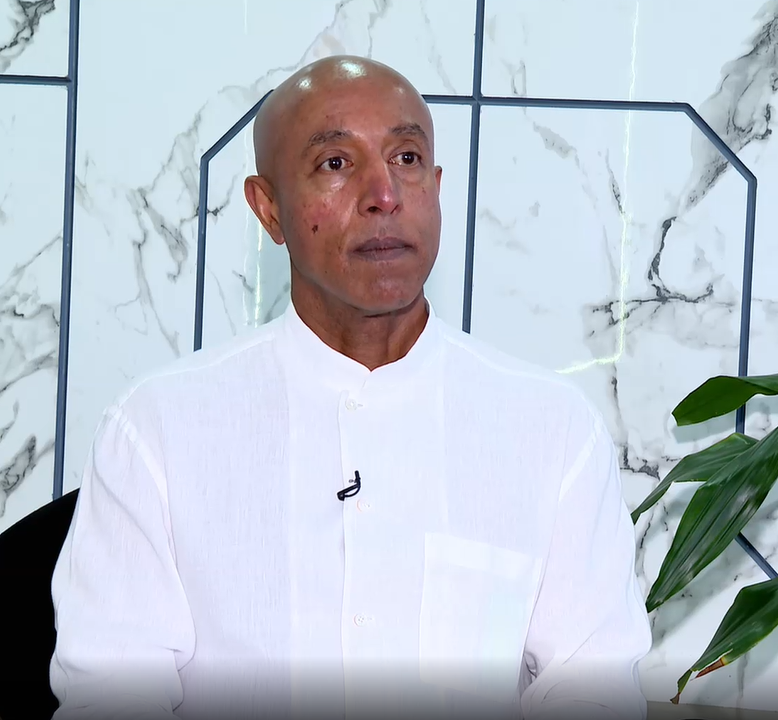

Addis Ababa November 11/2022 /ENA/ The Ethiopian entrepreneur Ermyas Amelga said allowing foreign banks to operate in Ethiopia is important to improve banking services and the finance sector.

He told ENA that allowing foreign banks to operate in Ethiopia will mainly bring competition in the financial sector and stimulate the banking service.

“Foreign banks will mainly create better financial competitiveness in this market. (And) competition is good as it motivates the banking sector to work to satisfy the needs of customers. It makes the banks to introduce new services, improve services, and service fees. So, it will stimulate the financial sector.”

According to the entrepreneur, the opening of the financial sector to foreign banks should not be seen as a new phenomenon as the country used to have foreign banks and insurances.

He believes that the restriction of foreign banks has negatively affected the financial system, competitiveness, service delivery and access to the wider population with new technologies.

“We are living in a globalized world. Trade, finance, technology and movement of people are now global. Sitting alone closing doors does not make profitable and it is not right. So, although late it is not new for us. Only few countries with wrong policy have closed the financial sector to foreign banks in the world.”

Ermyas argued that the recent opening of the telecom sector in Ethiopia has improved services, and the same will be true for the banking sector.

“The banking system does not reach out to the vast population. It is mainly for organizations, institutions and for wealthy individuals. The local banks cumulate deposits from ordinary people, but they do not give them credit. They give the deposits collected from the vast population to few rich people. Most of the population is not benefiting. The interests the banks pay for the deposits are not rewarding when compared to the inflation. There are no additional services that benefit the public. The foreign banks will possibly fill this gap.”

The entrepreneur stated that East Africa and West Africa banks have now replaced the European and Americans after the latter exited decades ago.

“These banks are expected to come to Ethiopia. Their major services are expanding mobile banking and credits to SMEs in the vast population. The local banks in Ethiopia are not playing there, and the foreign banks will fill this huge gap.”

He thinks that they will not do the same services covered by the local banks because they do not know the country’s economy, business environment, customers and they cannot give big credits. “May be they will provide bank services for the big foreign investment companies in Ethiopia because they know them well in other countries.”

However, some critics raise concerns about how Ethiopia controls foreign banks.

Respond to this, Ermyas stated that the banks are international banks and give priority to their name and reputation and they certainly will abide by the law of the country.

“The coming of the foreign banks will fill big market gap. They will come with big capital based on directive. Above all, they will bring knowledge and competition as well as professionalism. There will also be an opportunity to train the human power in the sector.”

New things should not be feared, the entrepreneur stressed, adding that instead working on risk reduction and maximizing the importance is crucial. “You cannot stop driving fearing car accidents.”